We have moved on from “let’s wait and see what happens, there might be a trade deal”. We now have a trade deal, but the fundamentals remain the same. The UK is now a “third country” in the EU customs language. To understand what is now involved in importing and exporting from the UK to Ireland you need to understand a little bit about how customs operate.

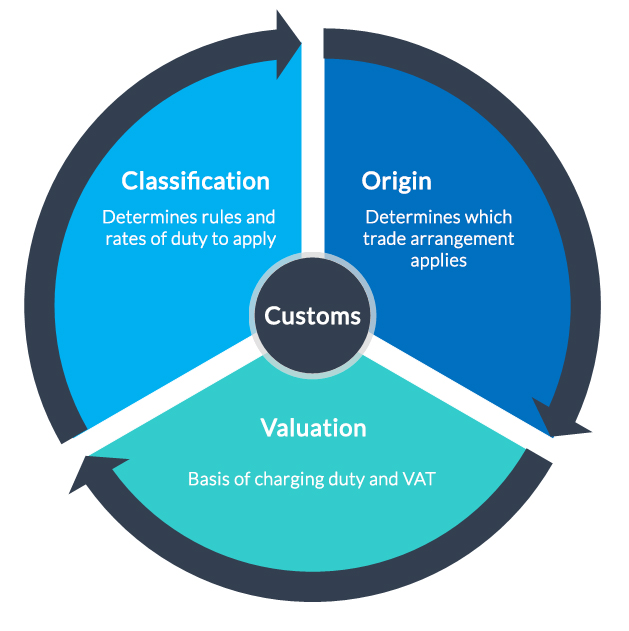

There are three fundamental pillars upon which customs are based, and when you make an import declaration (or your agent makes it on your behalf) you are making a legal declaration to Irish customs. It's important to get it right to allow your goods to enter/exit the country in a fast and efficient manner but more importantly to ensure your paperwork and systems are in order if you face an audit further down the road.

Origin

Where did the last “major transformation” take place on the goods you are importing, if you don’t understand this statement then it possible you don’t know the origin of the goods. Just because the supplier of the goods you are buying are in the UK its doesn’t mean the goods are of UK Origin.

Classification

Have you used the correct code to describe your goods, again you need to think long terms, choosing a Taric code with the “favourable duty rate” is not the correct mindset to apply when determining your HS code? Coding your product is not an easy process.

Valuation:

Sound simple but how is the value of the goods on the commercial invoice calculated; have you used the correct INCO term?

Services we offer:

- Review your supply chain and help you decide if you need to source elsewhere. Importing from the UK carries additional cost now, there is no way around this.

- Help you identify your product tariff codes

- Advice on INCO terms, and how to prepare your paperwork (commercial invoice etc)

- Calculate your landed costs (costs are going to increase)

- Get you set up with a customs clearance broker.

- Apply for BTI’s (binding Commodity codes), not a decision to be taken lightly.

- Advice and assistance in customs audit if you have been chosen for one.

- Apply for an EORI number, (you don’t need our help to do this, but its step one and you need to get it done).

The link below is the revenue website